Whenever the subject of pet insurance comes up with one of my clients, the question they’re most likely to ask is: “Is pet insurance worth it?” Every time, with every client, my answer is always a resounding “absolutely.”

Usually, my clients will then express concerns over “wasting” money on pet insurance premiums, or say something like, “There are too many exclusions, like chronic diseases and genetic conditions, to make it worth it.” But with all the different options that have opened up for pet insurance in the past few years, and with today’s animal health market being what it is, I can confidently say it truly is worth it.

One of the top comments I hear from my clients whose pets have experienced an unexpected accident or injury is, “If only I had pet insurance.” It breaks my heart when pet parents are forced to choose “economic euthanasia” – letting a beloved animal go because they can’t afford what it would cost to save them.

To avoid you ever having to choose between your pet’s life and a mountain of debt, I’m here to convince you why pet insurance makes more sense these days than ever.

How Does Pet Insurance Work?

Pet insurance works the same way as human health insurance, helping to pay for large, unexpected expenses for which pet owners would otherwise have trouble paying out-of-pocket. Nowadays, several companies offer it, with most allowing you to customize your policy by selecting from several deductible and copay options to find a premium that fits your budget.

There are basic plans that only cover accidents, some that cover accidents and injuries, and others that cover accidents, injuries, and genetic/hereditary conditions. The more comprehensive the coverage, the higher the cost.

Many plans have a deductible, meaning there’s a certain amount you must pay out of pocket before coverage kicks in. This could be anywhere from $0-$2,500 in a plan year, depending on the type of coverage you select. In general, having a higher-deductible plan means you’ll get a better percentage of your money back.

The main difference to understand between human health insurance and pet insurance is the current reimbursement model used by pet insurance. With yourself, you pay a copay when you go see the doctor, and insurance covers the rest. With pet insurance, you pay the full amount upfront at the vet, submit a claim to the insurance company, then get reimbursed later. Depending on your policy, you’ll receive back anywhere from 20%-100% of the total cost.

How Much Can I Expect to Pay for Pet Insurance?

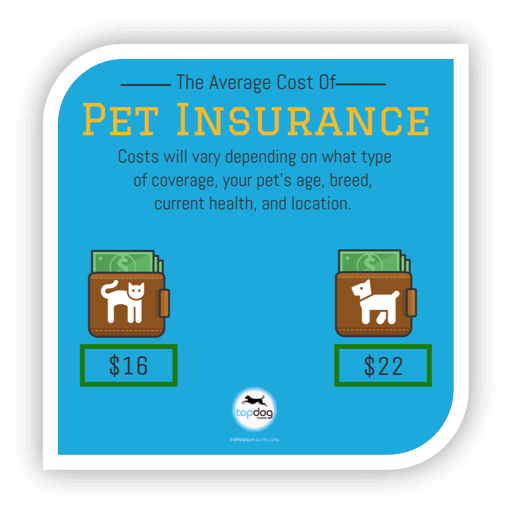

The average cost of pet insurance for dogs is around $22 per month, while pet insurance for cats is around $16 per month, according to Consumer Reports.

With that said, costs will vary depending not only on what type of coverage you decide on, but also on the age, breed, and current health of your pet, as well as where you live. Typically, the price of insurance goes up as your pet ages, purebreds can cost more because of hereditary issues, and if vet care is higher in your area than average, this will be factored into your premium.

The Pros and Cons of Pet Insurance

Pros:

Premiums Can Be Low: If your pet is young and healthy or you choose a plan with less extensive coverage, monthly costs can be extremely cheap.

You Can Choose Your Vet: Unlike human health care where you often can’t go out of network, all vets accept all pet insurance. Therefore you can be sure that any vet or animal hospital you go to will accept your coverage.

Deductibles Are Typically Affordable: If you’ve ever taken your pet to the emergency vet, you know just how pricey an unexpected illness or injury can be. If your animal has an unexpected incident that requires emergency care, you’ll often end up paying at least the cost of the deductible anyway.

You Get Peace of Mind: You can rest easy knowing that if something unexpected happens to your pet, you’ll have the financial help you need to get them healthy again. This, in my opinion, is priceless.

Cons:

Premiums Can Be High: If your pet is older, in poor health, has a genetic or hereditary condition, or you choose a plan with extensive coverage, premiums can be pricey. When looking at your options, you’ll want to ensure the annual cost makes sense.

It Doesn’t Cover Everything: For example, routine wellness checkups are typically not covered. Be sure to check and understand your plan thoroughly before committing.

The Current Reimbursement Model Can Be Tricky: Since you’ll initially need to pay for the cost of care yourself at the vet (even though you’ll be reimbursed later), this means you’ll still need to be able to get the money together upfront.

The #1 Question to Ask Yourself

To see if you would truly benefit from health insurance, ask yourself this simple question: “Would I be willing to spend $10,000 to save my pet’s life?” If the answer is yes, but you’d have trouble paying for it out of pocket, pet insurance is for you.

Of course, this scenario may never occur. Your pet may live a long, healthy life free of injuries or health complications. However, I have seen far too many loving pet parents agonize over the decision of whether or not to perform a costly surgery or medical procedure (that would save or greatly increase the quality of their pet’s life), whereas the answer would be a no-brainer if only they had pet insurance. My hope for you is that it never comes to this.

How Do I Get Pet Insurance?

A great place to start is to compare coverage from several of the leading companies here. This helpful site lays out the pros and cons of the different plans clearly, so you can easily see what would be the best fit for you and your pet/s.

Also, don’t delay. The best time to get pet insurance is always NOW. The younger your pet is when you enroll them, the more you’ll maximize your savings. Plus, most policies have waiting periods that don’t allow for immediate coverage following an accident or illness, which prevents people from signing up only when they know they have a big bill coming. The lesson here is to apply for pet insurance now before you end up needing it.

The Bottom Line

If you’ve ever had the unexpected happen when it comes to your pet, and had to choose between their health and being buried in debt, chances are you don’t need convincing – in fact, you probably went out and got pet insurance after the fact, so it doesn’t happen again.

Even if your pet has always been in good health, I highly urge you to look into pet insurance. While hindsight is always 20/20, so much pain and strife can be avoided for relatively little money per month, before you’re faced with a decision no pet parent should ever have to make. In addition, if your dog is diagnosed with osteoarthritis or similar conditions, supplements such as GlycanAid HA and Flexerna Omega are often covered by pet insurance.